[ENG]Telco’s + Gaming & How India is Connecting 500M gamers.

🔑Key Learnings in this Piece

Telecommunications companies around the world are recognizing the global boom of the games industry and want a piece of the action.

There are about 8 telco/gaming business models in the world right now such as Esports Sponsorship, Cloud Gaming, and In-Game Partnerships.

India is a unique case study where telco’s have successfully integrated gaming into their strategy, due to India being mobile-first, young, increasingly tech literate.

Chatting with Payal Aher, Indian telco gaming veteran revealed Jio’s plan to meet customers across multiple price points and ensuring there are compelling games for platforms are low-end as feature phones to high-end smart phones. Learn More

Telco’s gaming strategies needs to be highly tailored to the market they serve, specifically customer platform preferences, disposable income and cultural outlook on gaming overall.

As someone who works for a telecommunications company (or “telco” for short), I have long been curious how they are taking advantage of the global gaming boom. Companies like Comcast and AT&T in the US or Bell or TELUS in Canada have found success in building reliable copper and fiber optic networks. However, in many ways, telco's can be slow to respond to trends, reliant on legacy tech stacks, and thus play a more observant role in cutting edge technologies rather than active market participants.

How can telcos, who own the very pipes in which console and PC gaming is powered, who own the very mobility networks that enable mobile gaming, enter the gaming space in a strategic way? Telco's around the world have answered that question differently but today let's focus on India given how successfully its largest telco, Jio, has answered it. But first let’s explore the telco gaming landscape first.

Telco Gaming Business Models

Below are a collection of business models that telco’s around the world are leveraging today to enter the gaming space. This is by no means exhaustive, and I’m sure I’ve missed some, but most models fall into one of these 8 buckets.

A channel of 242k subs posting this recap which has 575 views.

As we can see there are many ways that Telco’s can integrate gaming into their strategy. For many the business value is clear. Increased brand awareness from an esports sponsorship or reduced churn from the gamer segment of internet customers who now have a dedicated internet product. The problem? It is difficult to measure what is incremental average revenue per user (ARPU) vs what is the revenue a telco would receive if they appeal to that segment in the first place.

Sure AT&T is more recognizable amongst gamers thanks to their ESL sponsorship, but did people seriously not hear of AT&T before this collaboration? Are viewers of the ESL Open more likely to subscribe to AT&T internet because of this sponsorship? Maybe, but maybe the driving factor for people picking an ISP is price, not brand association with gaming.

Maybe despite all the goodwill that AT&T has bought from gamers through this collaboration is offset by the blunt reality that tech-literate gamers know that the differences between ISP’s are nominal at best and you don’t need much more than a 75Mbps speed plan to run most things. We know gamers spend more typically on internet plans but is that because they naturally steer towards internet plan tiers to suit their bandwidth-heavy activity? Do they compare AT&T and Comcast and dismiss Comcast for not being “gamer enough” from a branding perspective? Do gamers feel patronized to be seen as a special-needs segment? The answers to these questions are tough to track down but would be critical to understanding the business case behind these gaming initiatives.

Maybe some UK Fortnite gamers go “wow cool the 02 Dome in Fortnite”, but does that actually translate to new mobility subscribers coming to the platform? If O2 took the same amount of money they spent creating the O2 Dome in Fortnite and created a rich discount offer on phone plans, would they generate similar business returns?

Things like ESL Mobile Open sponsorships, O2 Dome’s in Fortnite, or even dedicated cloud gaming solutions like Deutsche Telekom’s Magenta Gaming are novel, don’t get me wrong. They seem intuitive to explore given our 2 reasons above:

Telco's own the networks, both wired and wireless required to run any online game.

Gamers as a market segment are high ARPU/LTV customers, with a higher willingness to spend on internet speeds or mobility data budgets than your typical customer. This is similar to Telco's fiercely competing over the suburban family customer segment in the west. High monthly bill, high usage, low churn.

But the jury is still out on how profitable these ventures are, and if there is one thing that is true about telco’s is they are incredibly shareholders first. Finely balancing the economics of their subscribers at a scientific level to ensure margin in every cranny. Unlike consumer products like Coca-Cola or computer monitors (both of which heavily sponsor esports), driving brand salience and highlighting competitive advantages on high viewership esports events make a lot of sense. It brings those brands more front of mind for consumers to recall at the point of purchase for a soft drink or computer monitor.

The same can’t be said for telcos. The telecommunications industries are oligopolies at best and monopolies at worst, and brand recall is not the primary marketing KPI they should be gunning for in the gaming space. Neither should they simply throw money at esports on the “boomer” perspective of “getting into gaming”. This approach is short-sighted and lacks the nuance needed to truly succeed.

So now let’s look to India, to see how they have answered the “getting into gaming” question successfully with their telco, Jio.

Indian Games Industry

Indian has blossomed economically over the past 30 years after becoming a more globalized, trade-friendly country. It’s liberalization over the 90’s and into the 2000’s brought with it advances in technology, jobs, education and more. Although this has created severe income inequality, it has also worked wonders in bringing young, tech-literate, citizens into the 21st century with smartphones and disposable income.

With the availability of cheap data, affordable smartphones, and better quality of network, Indians now have better access to games on their mobile phones. The COVID -19 pandemic, and the subsequent lockdowns imposed by the Indian government, led to growth of Indian mobile games market as more people were playing games on their smartphones while staying home.

India at a Glance(2021)

Total Population: 1.38B

Gaming Population: 340M

Avg Weekly Playtime: 14.1 Hours

5- Year Revenue CAGR: 29.8%

This narrative is very similar to the African Games Industry - if you're curious about gaming in this region, check out my earlier post where I interview Usiku Games founder, Jay Shapiro!

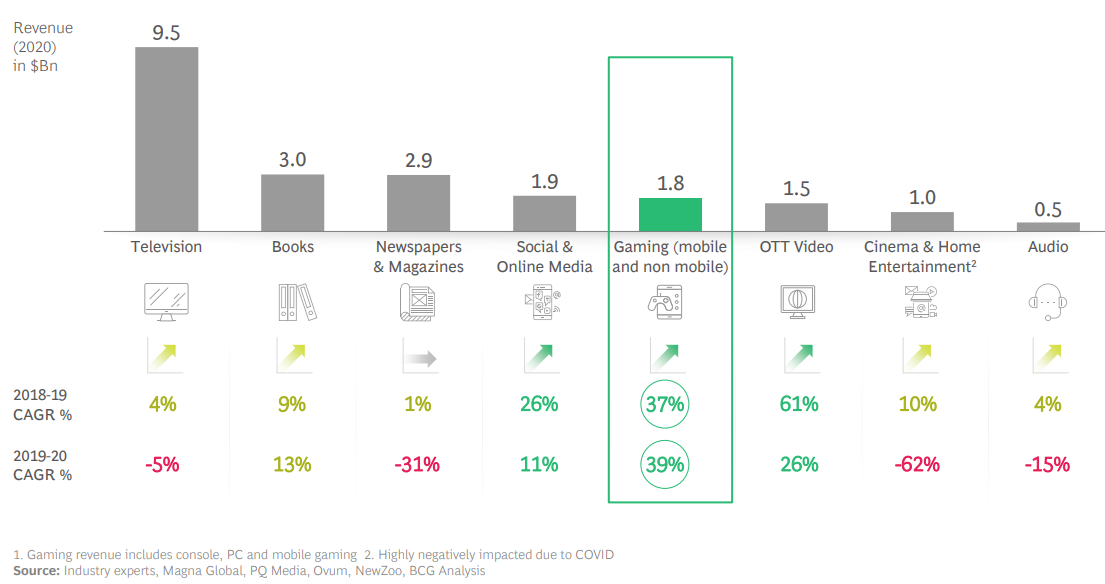

PC gaming is also growing, although the market is smaller than its mobile counterpart. According to a survey by InMobi, 45% of Indians started to play games on their smartphones during the lockdown as an alternative to other entertainment. What’s interesting is we’re also seeing that gaming, uniquely as a sector, is outperforming other media formats.

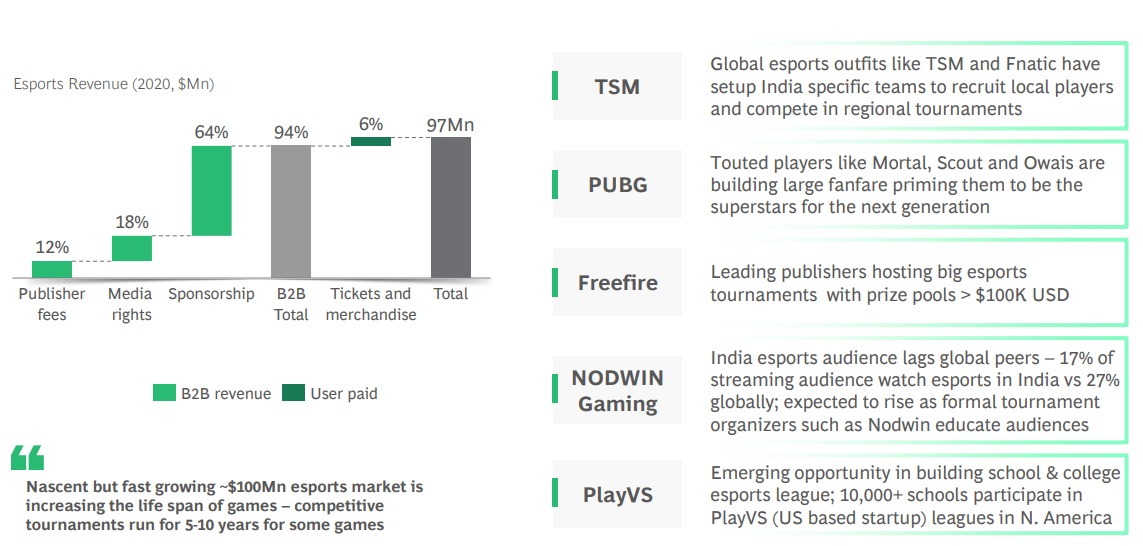

Esports is also a booming sector in the Indian games industry. Similar to that of Singapore and other South East Asian markets, the lack of PC gaming adoption has not curbed the rise of esports. The challenge India uniquely faces is the somewhat slow of rate of monetizing its esports fans. The interest to engage the content is undoubtedly there yet ARPU still lags behind as seen by tickets & merchandise only accounting for 6% of total esports revenue. This is expected to change as Indians see more money in the pockets from economic growth.

Talking to a Telco + Gaming Veteran

Payal Aher

I had the pleasure of talking to Payal Aher, who does gaming partnerships with Telcoms, OEMs, Publishers & Studios and has been a part of the global games industry for over 7 years. Below are some of the abridged thoughts of answers during our interview.

If you would like to read the full interview, check out this link

What is prompting such a boom in Indian Gaming?

India has the second largest gaming market, and I'll tell you why. It is because most of our population is below 45 years of age. So, we have a lot of young people who are mostly interested in gaming at an early age. But gaming has been a luxury, it is still a luxury for many people, due to accessibility to a lot of platforms.

So, what Jio did is they gave a lot of internet services for free in their initial state when they launched it so people could build a habit of using the internet and playing games.

Jio also has investments from Facebook and Google to scale up these high-growth gaming markets, like India - they are creating their own platforms, or doing some kind of partnership, which is escalating the industry right now. So, the point was to reach and every audience from the lower middle class to upper middle class to high end classes and ensure they have gaming accessibility on all their platforms.

What obstacles are you encountering?

I would say in India, people do not believe in giving their credit cards over easily. It would be easier to use wallet money. So, what Jio did was, they introduced their own payment platform, they introduced their own wallets so people might be comfortable in putting some money in that wallet, and then it would be deducted when purchases are made. So, this is one of the things that a lot of third-party wallets like Paytm, try to focus on – penetrating the gaming market.

Indians would like to play it and then if we like it, we’ll buy it. So, I'll tell you one thing. Jio recently launched a premium game service for people to download premium games, and we’re seeing a lot of transactions from the age group of 14 to 20 years and below. So, these games are really high-end games, we are offering it on TV on the DTS services in certain boxes. Why? Because in India, people are not able to afford Xbox, there is only 10% of the market who could afford and Xbox or PS4 are similar services. So, we wanted to have a console service for those people who want to play such games with a hard controller or a soft controller.

How do the financials look for such a strategy? What’s the business case?

Regarding financials, the people from the beginning did not see gaming as a potential market. So, they were not investing heavily in the market. There were a lot of up and coming platforms that had to be shut down after a couple of years because of lack of investment. But now we are seeing some good potential investments since the pandemic. It's a good opportunity, people are looking into it, and a lot of foreign investors are investing it in India heavily to scale this up to tap this market to tap users, the massive huge user base we have in India, and how to monetize these users and how to give them a better platform to play, how to give them better servers, how to give them better devices etc.

So what does this look like all together? Meeting customers at different price points and hardware capabilities?

For example - we launched a game subscription service where you can have a bundle of games - 150 rupees and you can access up to 200 games. This was an experiment to see what people were comfortable paying for. Well, if you're not comfortable, we introduced payment wallets. If you're not comfortable buying an Xbox, we're offering a cheaper version of console services, if you're not able to convince your parents to buy a hard controller by yourself, you're given an app like a smart controller, and then you can play games.

What’s next for Indian telco’s and their gaming involvement?

I would say, the party is just starting. People see a large market, people really work for a couple of years, the foreign companies, they come and go, that's just to wait and watch us doing a lot of big things, even the other gaming partners and the other gaming studios, the platforms, and they're doing a lot of good partnerships. They are coming into eSports, they're coming into Cloud, Jio is coming into Cloud, and Jio is coming into eSports. They're being focused on users and game developers.

We want people from around the world to see India as a potential market and we want them to make their content available to the Telcos, we are creating very huge things in India. But as we scale up, it also takes time for habits to change around in-game payments and subscription payments. But when they do - It's going to be massive.

It's going to be very different from now what we talk. If you have this interview recorded, and then we see it again in the future, it's going to be very different in terms of users, in terms of content, in terms of platforms. We are going to be the largest market in the future from what I see down the line.

To Close

Big thanks to Payal for the interview! Again if you want to read the full interview - check out this link.

After finding different telco business models and learning from the best in the biz, being Jio in India - I’ve arrived on some telco/gaming best practices to close.

Getting into gaming for the sake of it isn’t a good enough reason to deploy time and capital. Building a cloud gaming platform from scratch may work in India with 300M+ subscribers, but for less populated, more mature market - don’t reinvent the wheel.

Don’t create a cloud gaming platform from scratch if you know everyone is using Xbox Game Pass.

Don’t try to create a new telco-specific controller when Sony and Microsoft have basically perfected controller design at this point.

Don’t sponsor esports tournaments unless you have data that people actually signed up for your internet because of the sponsorship.

When so much of consumers’ decision around which Telco to sign up with is price-based, steer away from from selling gamers on vague service quality differences. A lot of telco’s globally share similar performance to their competitors in terms of download/upload speed. If you want to win the hearts and wallets of gamers, communicate what exactly will you give them that your competitor can’t?

Do users get free Xbox Game Pass for 6 months? Nintendo Eshop credits? Special discounts on peripherals? Next-Gen consoles? Anchor the value prop in clear add-ons that you know gamers care about.

Be very aware of the market you are serving and tailor your approach accordingly. A telco gaming strategy for Canada will look very different than one for India for example. Below are some guiding questions that may help.

What devices are people playing games on? Feature phones? Smartphones? Consoles?

What sorts of games are they playing?

Are they willing to spend? If so how?

What role does esports play?

How does your market’s culture view gaming? How normalized is it?

Ultimately before telco’s try to tackle the question of “getting into gaming” they need to understand what’s being asked? What is the market need that is not being given to gamers today, and how can telco’s uniquely satisfy those needs? The fact that there are nearly 8 approaches to this question suggests that the strongest answer is still fuzzy at best.