Japan Games Industry | 5 Facts

Mergers and Acquisitions

2023 was relatively quiet for global gaming M&A, but Japan was buzzing with activity. The "Big 4" — giants of the Japanese gaming industry — were making strategic moves to enhance their portfolios and market presence. PlayStation Studios' acquisition spree, including Firewalk, exemplifies the aggressive expansion strategies employed. 20 studios under the Playstation Studios umbrella is no small task and is certainly they’re way of derisking their revenue streams. What I mean by that is that with PS5 console sales slowing and PS Plus subscriptions underperforming, Sony is clearly trying to beef up it’s P&L by having more line items (or studios)

Additionally, significant investments like the Saudi PIF becoming Nintendo's largest external shareholder underscore the global interest in Japan's gaming sector. This is such a funny combination in my opinion. Saudi is pumping billions into gaming, whether through esports ventures or just equity investments like this. Regardless Mario x MBS is a funny image.

Steam's Dominance

Steam has dominated the Japanese PC gaming market, a feat attributed to successful localization efforts. The platform's significant market share reflects a keen understanding of Japanese gamers' preferences and the effective tailoring of services to meet these demands. It invites the question “why do any of these other platforms struggle to keep pace?”. Steam outperforms other PC game distributors in (probably) every other market (except China) but what are these other platforms missing…?

This dominance not only showcases Steam's strategic market positioning but also highlights the evolving preferences of Japanese gamers, increasingly leaning towards PC gaming alongside traditional console loyalty.

Aging Gracefully in Gaming

The Japanese mobile gaming market reveals a fascinating trend: the longevity of top games, with an average age of 8 years among leading titles. Japan is country and culture of long-standing traditions. Aversion to the latest fad and obsessed with proven, reliable, predictable games.

This fact really demonstrates just how powerful Apex Legends mobile is from EA, being a top game in Japan before ultimately getting shut down. Launching new and successful IP (like Apex) into Japan is really challenging and it’s a shame that EA had to shutter the game.

This longevity speaks volumes about Japanese gamers' loyalty to established brands and polished experiences. It indicates a challenging environment for new entrants but also underscores the value of quality and brand strength in achieving lasting success in Japan.

Side note about glitches? It's clear that glitches and bugs are the biggest turn-offs for Japanese players, outweighing concerns over hackers, pay-to-win models, or even pricing. This preference for glitch-free experiences highlights the high expectations Japanese gamers have for quality, driving developers to prioritize meticulous game development and testing. This reminds of how Japan succeeded so well in auto-motive and consumer electronics in the 1980’s. They had this unrelenting focus on quality and reliability - clearly traits that Japanese gamers have inherited from that generation.

Legacy Consoles

The enduring popularity of legacy consoles among Japanese gamers, with many still using devices over a decade old, illustrates a deep-rooted affection for traditional gaming experiences. This data doesn’t reveal how much dust these old console may be collecting - sure these consoles are owned but are they used.

We all knew Xbox has struggled to tap into the Japanese market for a while, but it’s almost an accomplishment that for nearly 20 years things haven’t changed. Depsite new xbox leadership over the years, studio acquisitions like Tango Gameworks and so much more - Phil and the gang just have not cracked this market open yet.

I would wager that team xbox may be trying to tap this market through “de-exclusivying” (definitely a word), certain titles. Rumours today (Feb 2024) are at least pointing into that direction.

Consumer Preferences

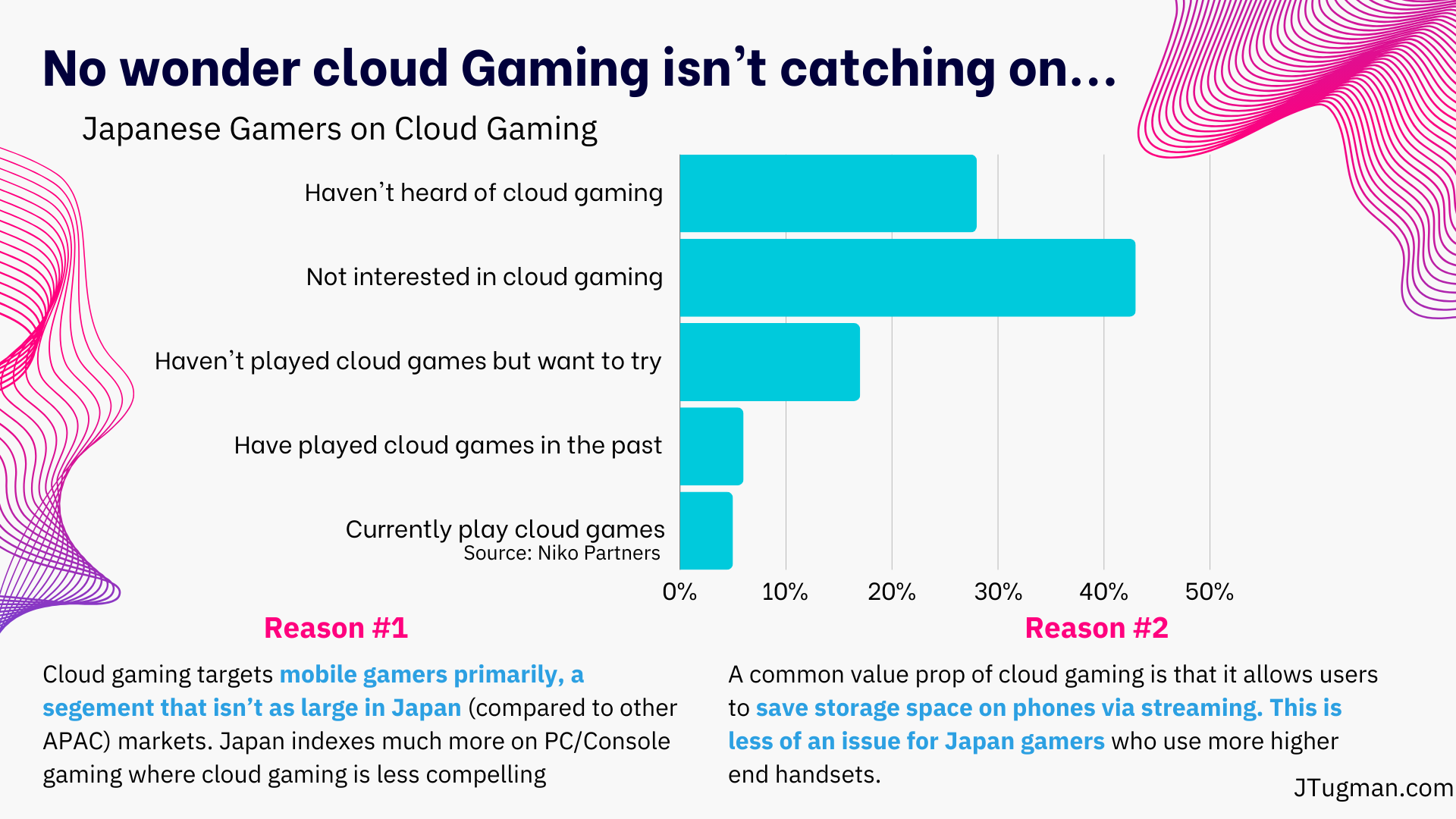

So we have consumers who love old games, play them on old consoles and enjoy PC games on the incumbent platform. What are the odds that they would be open to fancy new ways of playing like Cloud? Pretty crap odds clearly.

The chart above from Niko Partners demonstrates this with the lukewarm reception towards cloud gaming, largely due to preferences for PC and console gaming over mobile and the high standards for gaming hardware in Japan. It's a clear signal that while innovation is welcome, there's a strong nostalgia and quality expectation that shapes consumer behavior.

The 2 key value props of cloud gaming (mobile first + space saving) just can’t land on the ears of a consumer who isn’t as mobile focused and who’s phone is latest gen.

My prediction? That Japan will be more willing to adopt cloud-hybrd console games like Microsoft Flight Simulator. These are games so compute intensive that a local console simply can’t render everything. The game needs to lean on Azure servers to provide the fidelity and frames per second the game is trying to produce.